Summary of U.S. Government

Expenditures and Income

Total U.S. Government Budget (2024)

Total Spending: $6.75 trillion

Total Revenue: $4.9 trillion

Deficit : $1.85 trillion

National Debt (End of 2024): ~$36 trillion

Mandatory Spending - (See Explanation)

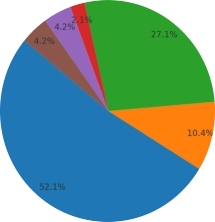

Government Expenditures : $6.75 Trillion

1. Social Programs & Public Assistance

•

Social Security: $1.46 trillion

•

Medicare & Medicaid (Healthcare Programs):

o

$912 billion

•

Veterans Benefits & Assistance: $210.9 billion

•

Other Social Welfare Programs: $1,482 per person

(average amount of tax dollars allocated per taxpayer

toward veteran and military benefits.

o

(includes SNAP, housing, and disability benefits)

Discretionary Spending (See Explanation)

2. Department of Defense Budget (2025): $883 billion

•

Veterans Affairs & Military Benefits: $3,367 per

person

3. Legislative Branch (Congress & Senate)

•

Salaries for Senators & Congress Members:

o

$94.28 million

•

Senate Offices & Committees: $68.36 million

4. Executive Branch

•

Department of Health & Human Services (HHS):

o

$130.7 billion (Discretionary)

o

$1.7 trillion (Mandatory)

•

Department of Commerce:

o

$11.4 billion (Discretionary)

o

$4 billion (Mandatory)

•

Department of Labor: $97.5 billion (See Description)

5. Federal Judiciary Budget (FY 2024): $9.1 billion

•

Salaries for Judges: $796 million (Mandatory)

•

Court Operations: $6.4 billion (Discretionary)

o

(salaries, expenses, clerks' offices, probation services)

•

Support Staff: Included in court operations and defender

services (Discretionary)

o

$1.5 billion for federal defenders.

•

Other Expenses (Facilities, IT, & Other Judicial Services):

o

$400 million (court security, IT modernization, and other

o

infrastructure costs) (Discretionary)

6. Other Federal Spending - Over $1 trillion annually (EST)

(Discretionary)

•

Infrastructure: Road and bridge projects.

•

Education: Federal student aid, grants,

o

and K-12 programs.

•

Research: Scientific funding (e.g., NIH, NASA, NSF).

•

Interest Payments on National Debt

o

(Over $1 trillion annually) (Mandatory)

Government Income (Revenue) $4.9 Trillion

2. Other Sources

•

Tariffs & Customs Duties

•

Fees & Fines (passports, national parks, etc.)

•

Federal Reserve Transfers (profits from bond

purchases)

United States Income - Expenditure

USA - News

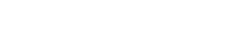

Income Taxes 52.1%

Corporate Taxes 10.4%

Payroll Taxes 27.1%

Excise Taxes 2.1%

Tariffs & Fees 4,2%

Fed. Transfers 4.2%

Government Income (Revenue) $4.90 Trillion

Government Expenditures : $6.75 Trillion

Deficit : $1.85 Trillion

How the Government Covers Its Deficit and

Where the Fed Gets Money

In 2024, the U.S. government spent $6.75 trillion

but only collected $4.9 trillion in revenue (mainly

from taxes). This created a $1.85 trillion deficit,

meaning the government had to borrow to cover

the shortfall.

How the Government Borrows Money

To cover the deficit, the government sells Treasury

bonds, bills, and notes (IOUs) to investors, banks,

and even foreign countries. Buyers of these bonds

lend money to the government in exchange for

future repayment with interest.

How the Federal Reserve Helps

The Federal Reserve (Fed) plays a role by buying

these Treasury bonds when needed, injecting

money into the economy. Unlike a regular bank,

the Fed creates money digitally,

Where Does the Fed Get Money?

The Fed does not print cash to buy government

debt. Instead, it adds money electronically to

banks’ accounts, increasing the amount of money

in the financial system. This helps keep interest

rates low, making borrowing cheaper.

Long-Term Effects

The national debt grows as deficits pile up year

after year. The Fed can later sell these bonds to

remove excess money from the economy.

If too much money is created, it can lead to

inflation, meaning prices rise.

Effect on National Debt

The deficit adds to the national debt, which

reached nearly $36 trillion by the end of 2024.

This means the government continues to pay

interest on borrowed money, further increasing

future financial obligations.

Copyright © 2025 globalgrype.com

All rights Reserved

Mandatory Spending:

Automatically funded based on eligibility laws. ie:

Social Security, Medicare, Medicaid, SNAP

Discretionary Spending:

Requires Congress to approve funding each year

Defense, Education, Transportation, FBI, NASA

Department Of Labor

Employment and Training

Administration (ETA):

•

Oversees workforce development programs,

including job training and unemployment

insurance.

Occupational Safety and

Health Administration (OSHA):

•

Ensures safe and healthful working conditions

by setting and enforcing standards.

Wage and Hour Division (WHD):

•

Enforces federal labor laws related to

minimum wage, overtime pay, and child labor.

Employee Benefits Security

Administration (EBSA):

•

Protects the integrity of pensions, health

plans, and other employee benefits.

Bureau of Labor Statistics (BLS):

•

Collects and analyzes essential economic

data, including employment and inflation

statistics.